41 mortgage credit analysis worksheet

10. maj 2009 ... Required Documents for Mortgage Credit Analysis . ... Mortgage Worksheet in the closing package, placed behind Form HUD-. It’s a common saying that buying a home may be one of the biggest — if not the biggest — financial decisions you’ll make in your lifetime. It’s potentially one of the biggest investments you’ll make, too, which is why it’s important to unde...

3 weeks ago - If you're a homeowner, you probably qualify for a deduction on your home mortgage interest. The tax deduction also applies if you pay interest on a condominium, cooperative, mobile home, boat or recreational vehicle used as a residence.

Mortgage credit analysis worksheet

It isn’t uncommon to hear advice when you have no credit including that you should build up your credit by getting a car loan or credit card. They’ll tell you not to close your accounts or run up your balances. In other words, these individ... Mortgage Credit Certificates. a. If a government entity subsidizes the mortgage payments either through direct payments or tax rebates, these payments may be considered as acceptable income. b. Either type of subsidy may be added to gross income, or used directly to offset the mortgage payment, before calculating the qualifying ratios. 5. Mortgage Credit Analysis Worksheet. Business » Mortgage. Add to My List Edit this Entry Rate it: (1.00 / 1 vote) Translation Find a translation for Mortgage Credit Analysis Worksheet in other languages: Select another language: - Select - 简体中文 (Chinese - Simplified)

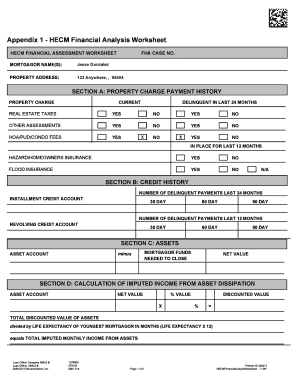

Mortgage credit analysis worksheet. HUD 4155.1 Table of Contents i HUD 4155.1, Mortgage Credit Analysis for Mortgage Insurance Chapter 1. Underwriting Overview Section A. General Information on the Underwriting Process Mortgage Credit Analysis Worksheet c. Borrower's - paid Closing Costs (from line 7c) Final Application decision Approved Rejected 1b. Co-borrower's Name 2b. Social Security # c.Total fixed payment-to-income (line 17i ÷ line 15f) d. Sales Concession (subtract this amount) a. Contract Sales Price or Construction Cost March 13, 2021 - An official website of the United States Government · Contents of Directory irs-pdf Cash flow analysis worksheets for tax year 2020. Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrower's income. Our editable, auto-calculating worksheets help you to analyze: Cash flow and YTD profit and loss (P&L) Comparative income; Liquidity ratios; Rental income

This workflow template illustrates the generation of credit reports for potential borrowers and the subsequent approval or denial of mortgage loans based on the borrower's credit history and financial standing. Purchase and download this template in PDF and Visio (VSD) formats. You can customize it to fit your own organization, or simply use it to better understand the Mortgage Loan Risk ... The following is a description of the steps to be taken when completing any of the Section 184 Mortgage Credit Analysis Worksheets (MCAWs). 1) Determine the type of transaction you are working with. 2) Select the appropriate tab at the bottom of the excel worksheet to display the MCAW designed for your specific transaction. FHA Mortgage Credit Analysis Worksheet. Determines the appropriate amount for an FHA loan. Term Source: LDD. Categories: Document. Hash Tags: #Origination. ©2020 The Mortgage Industry Standards Maintenance Organization. The Mortgage Credit Analysis Worksheet (MCAW) (HUD-92900-PUR) has been revised to reflect changes to FHA's treatment of closing costs. Line 10c Unadjusted Acquisition: This reflects the amount the buyer has agreed to pay for the property as well as any closing c osts to be paid by the borrower from Line 5c.

Acronym Finder is the largest and most trusted database of over 4 million acronyms and abbreviations. What does an abbreviation stands for? The answer is here If you’re a North Carolina homeowner who has experienced a financial hardship due to COVID-19, you may be eligible for assistance with housing-related expenses · Learn more or apply online using the buttons below or call 1-855-MY-NCHAF (1-855-696-2423) Executive Order 12866 directs agencies to follow certain principles in rulemaking, such as consideration of alternatives and analysis of benefits and costs, and describes OIRA's role in the rulemaking process. Regulations under EO 12866 Review Regulatory Reviews Completed in Last 30 Days · ... Mortgage Credit Analysis for Mortgage Insurance, One- to Four-Family Properties, ... qualifying ratios on the mortgage credit analysis worksheet.

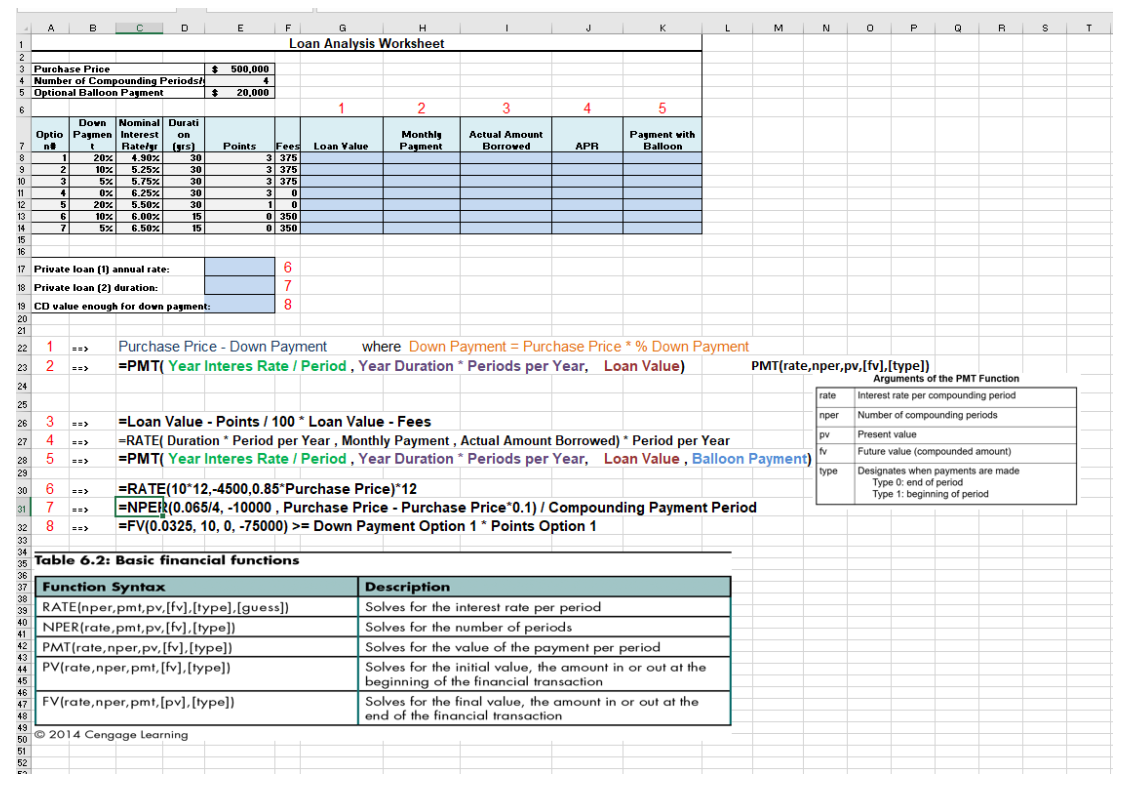

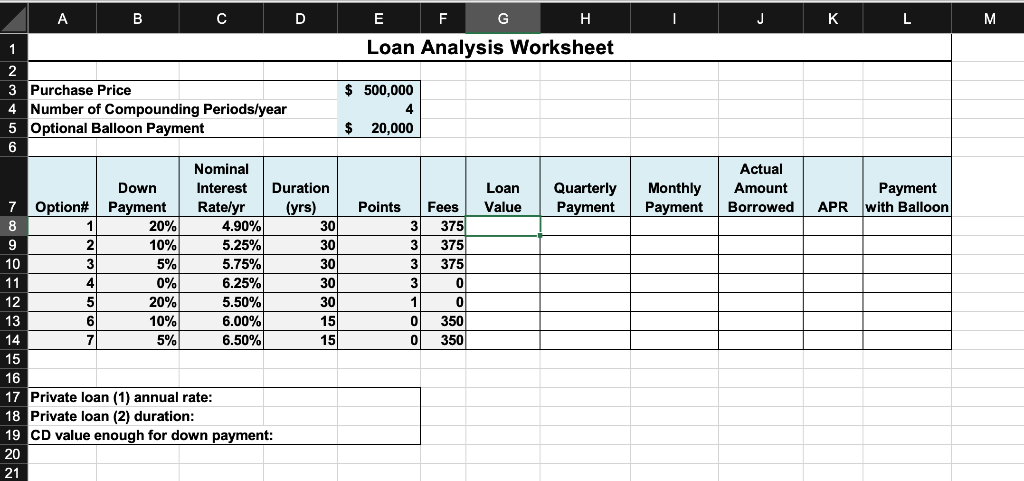

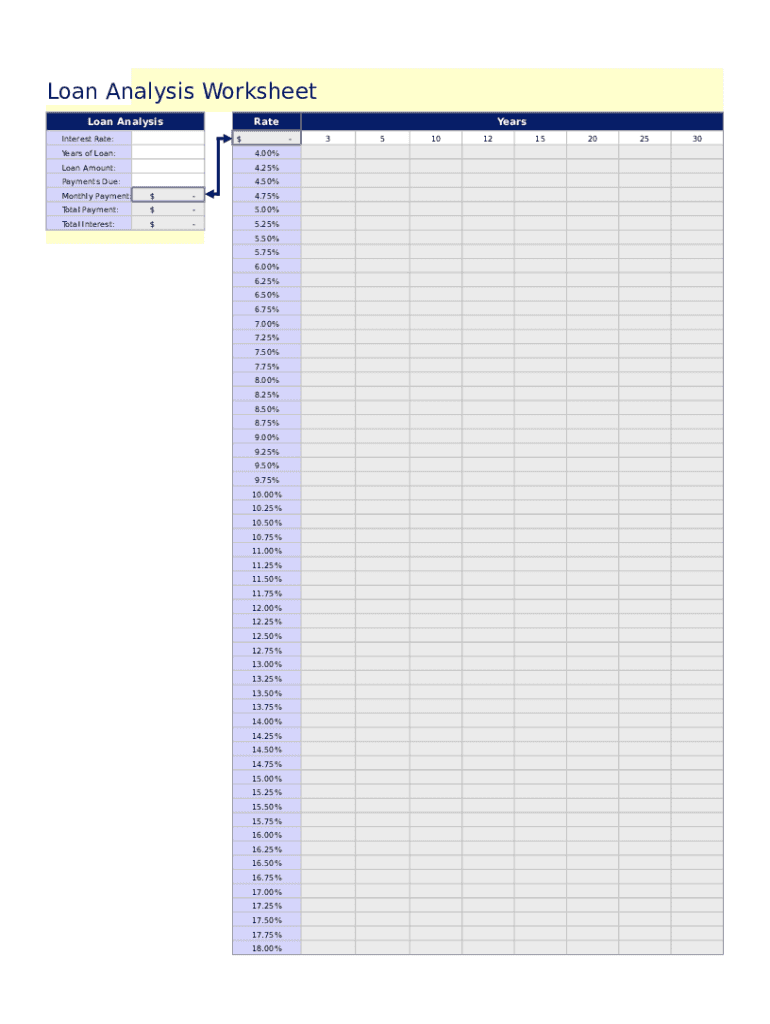

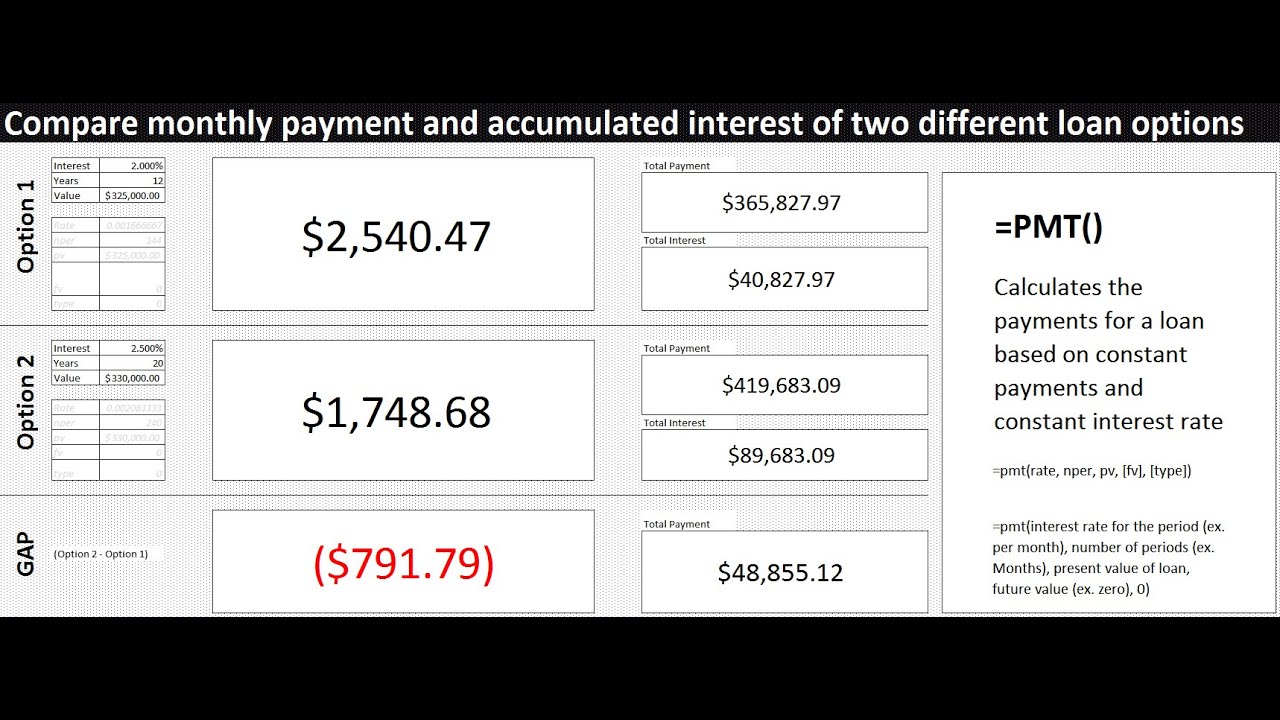

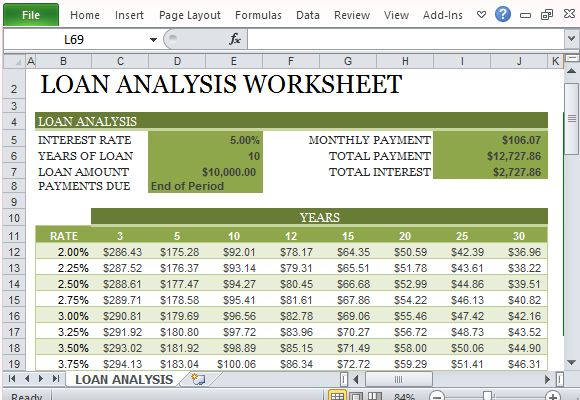

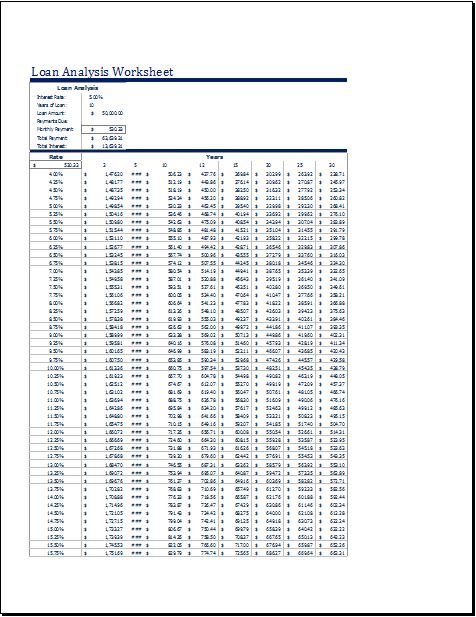

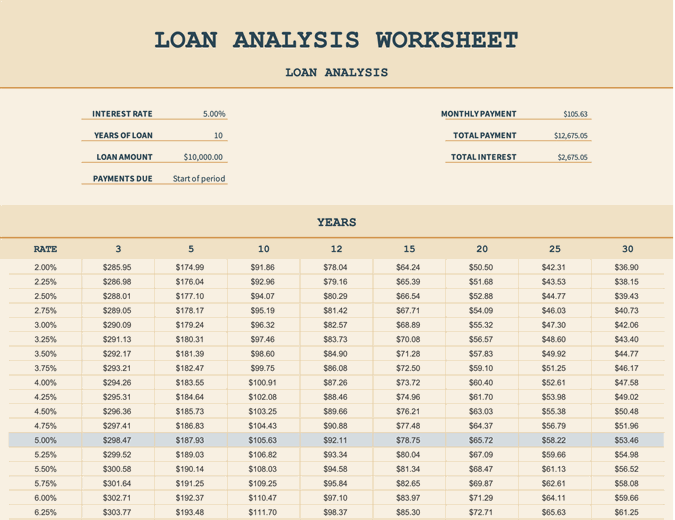

Use this accessible template to analyze various loan scenarios. Enter the interest rate, loan term, and amount, and see the monthly payment, total payments, and total interest calculated for you. Other interest rates and loan terms are provided for comparison to help you make the choice that's ...

The Mortgage Tax Credit Certiicate (MCC) program was established by the Deicit Reduction Act of 1984 and was modiied by the Tax Reform Act of 1986. 8 . Under the law, states can convert a portion of their federal allocation of private activity bonds (PABs) to MCC authority on a four-to-one basis. Mortgage

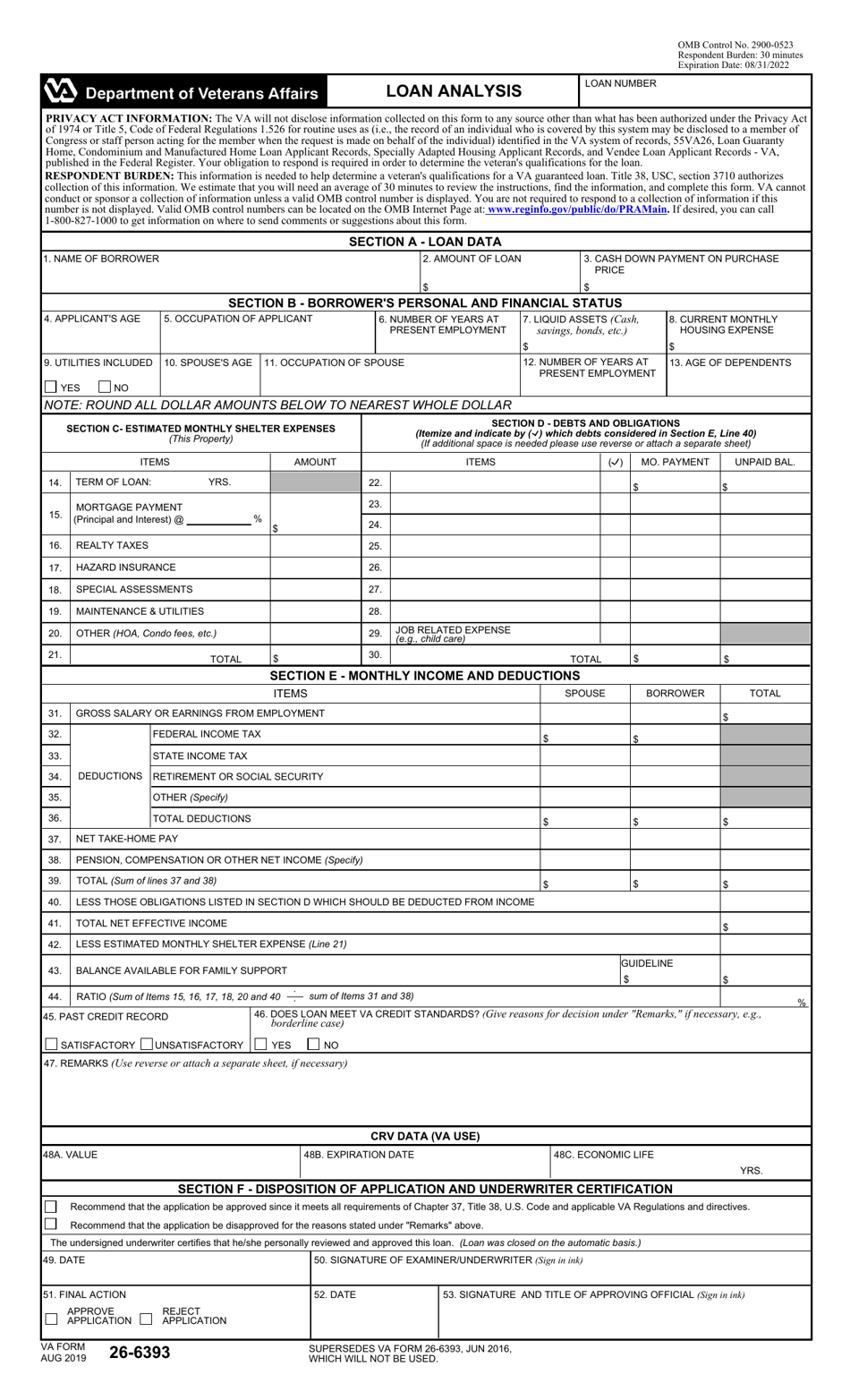

45. PAST CREDIT RECORD 48A. VALUE. 48B. EXPIRATION DATE €47. REMARKS€ (Use reverse or attach a separate sheet, if necessary) 48C. ECONOMIC LIFE YRS. CRV DATA (VA USE) €46. DOES LOAN MEET VA CREDIT STANDARDS?€ (Give reasons for decision under "Remarks," if € necessary, e.g., € borderline case) SATISFACTORY UNSATISFACTORY. YES AMOUNT ...

The following is a description of the steps to be taken when completing any of the Section 184 Mortgage Credit Analysis Worksheets (MCAWs).

Loan analysis worksheet · More templates like this · Find inspiration for your next project with thousands of ideas to choose from.

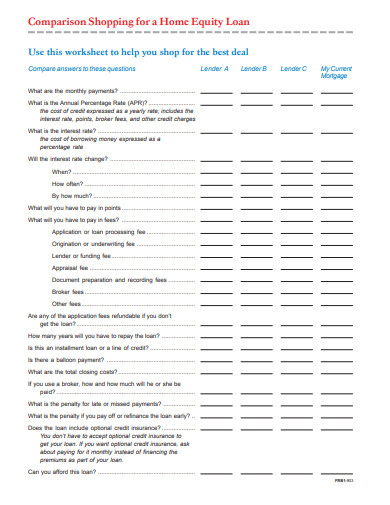

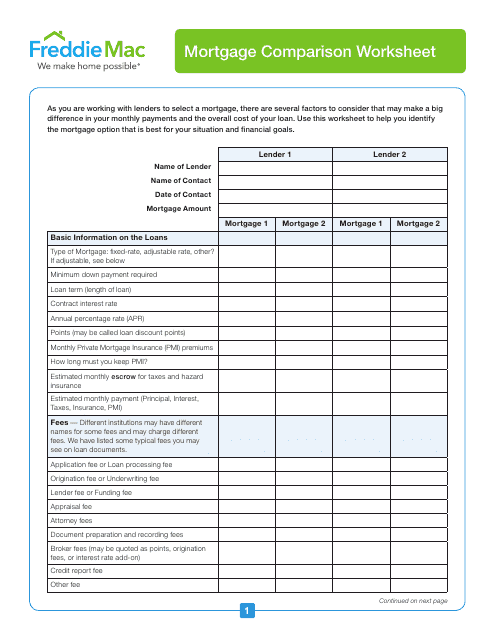

Credit Report Fee This is a report to get your credit history and score. Costs up to $75. Appraisal Fee This is paid to the appraisal company to conirm the fair market value of the home. A single-family home costs between $450 - $650. Building Inspection Inspector fees typically range from $450 - $1,000. Survey

Loan Analysis Worksheet offers a thorough set of tables of rates of a loan through the years for different standings of loans; mortgage, installment, and etc. Our template gives an assortment of little and huge tables for comparison. Make use of this worksheet format to dissect different loan situations. Enter the investment rate, credit term ...

Self-Employed Borrower Cash Flow Analysis Our editable, auto-calculating cash flow worksheets are ready to download Housing Finance Agencies (HFAs) We work closely with state and local Housing Finance Agencies (HFAs) and support these mission-driven mortgage investors with marketing, training, homebuyer education and certification programs and more

February 25, 2021 - Information about Form 8396, Mortgage Interest Credit, including recent updates, related forms, and instructions on how to file. Form 8396 is used to figure your mortgage interest credit for the current year and any credit carryforward for the following year.

Credit analysis software helps banks perform spreads and understand the health of each borrower's business. Credit analysis software simplifies the development of financial ratios that are used to determine the creditworthiness of customers. _____ Read our article, "5 Types of Commercial Loan Software" for more details.

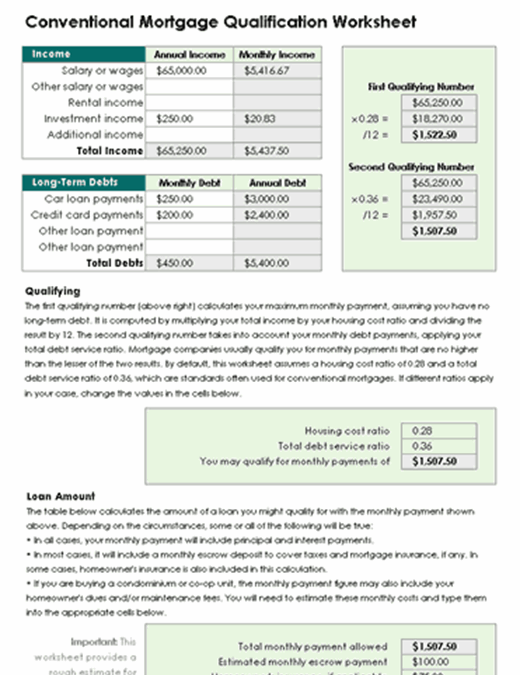

Section 1026.43(e)(2)(vi) provides that, to satisfy the requirements for a qualified mortgage under § 1026.43(e)(2), the ratio of the consumer's total monthly debt payments to total monthly income at the time of consummation cannot exceed 43 percent. Section 1026.43(e)(2)(vi)(A) requires the creditor to calculate the ratio of the consumer's total monthly debt payments to total monthly income ...

At the Federal Housing Administration (FHA), we provide mortgage insurance on loans made by FHA-approved lenders.

Mortgage Credit Analysis Worksheets (MCAWs). 1) Determine the type of transaction you are working with. 2) Select the appropriate tab at the bottom of the excel worksheet to display the MCAW designed for your specific transaction. Some types of transactions may require the completion of more than one form.

Whether you’re interested in quick fixes or are looking for long-term solutions, working to improve your credit is a good idea. Here are some tips to get you started. Consistently making credit card and loan payments on time is one of the b...

View on Westlaw or start a FREE TRIAL today, § 37:10. Mortgage credit analysis worksheet, Secondary Sources.

Spot and avoid scams and unfair, deceptive, and fraudulent business practices with tips from the FTC, America’s consumer protection agency.

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes.

The Mortgage Credit Analysis Worksheet has been revised to reflect changes to the percentage of financeable closing costs. Several of the more important changes are discussed below: Line 5 Closing Costs: On line 5a, show the total buyer's closing costs of the transaction. On line 5b, subtract any amount of buyer's closing costs paid by the seller.

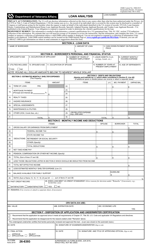

Mortgage Credit. Analysis Worksheet. Purchase Money Mortgages. OMB Approval No. 2502–0059. 6. Current housing expenses. 7. Term of loan. 8. Interest rate.

November 6, 2020 - Fees for other services ordered ... report, credit report, tax service and flood certification fees · Closing or escrow fees paid to the settlement agent or closing attorney · Document preparation fee charged by the settlement agent ... You can use the Lender Fees Worksheet to perform a detailed review of mortgage closing costs ...

Related: Alternatively you to this free mortgage Excel template design for Loan Analysis you can download financial PowerPoint templates and slide designs to present to a mortgage agency or make presentations on mortgage and loan analysis. Aside from this, the loan analysis worksheet template can help you determine how much of your monthly payments go towards your loan and how much goes ...

The proposed information collection requirement described below has been submitted to the Office of Management and Budget (OMB) for review, as required by the Paperwork Reduction Act. The Department is soliciting public comments on the subject proposal.

CreditSmart® is financial and housing education on your terms.

MCAW - Mortgage Credit Analysis Worksheet. Looking for abbreviations of MCAW? It is Mortgage Credit Analysis Worksheet. Mortgage Credit Analysis Worksheet listed as MCAW. Mortgage Credit Analysis Worksheet - How is Mortgage Credit Analysis Worksheet abbreviated?

Now that your loan is registered you will receive some follow-up emails with instructions in the coming days. Mortgage Underwriting. b. VA UNDERWRITING CHECKLIST _____ VA Disclosu

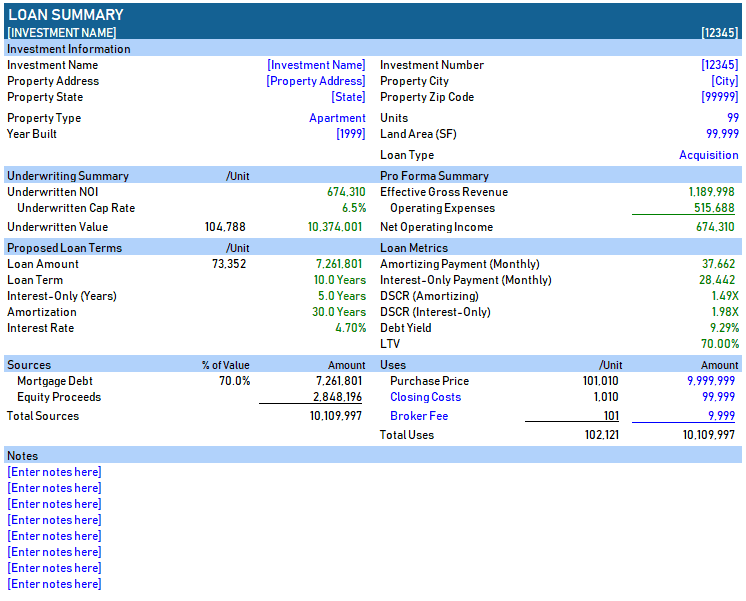

Download the Commercial Mortgage Loan Analysis Model. To make this model accessible to everyone, it is offered on a "Pay What You're Able" basis with no minimum (enter $0 if you'd like) or maximum (your support helps keep the content coming - typical real estate Excel models sell for $100 - $300+ per license).

Mortgage Credit Analysis Worksheet c. Sales Concession (subtract this amount) d. Acquisition costs (sum of lines 14a + b - c) Form HUD-50132 (1/01/14) Streamline with Appraisal Refinances b. Interest Due to payoff d. Subordinate Mortgage(s) Interest Due or (line 12) x 0.9875 if <= $50,000 b. Interest Due to payoff d.

The following is a description of the steps to be taken when completing any of the Section 184 Mortgage Credit Analysis Worksheets (MCAWs). Determine the type of transaction you are working with. Select the appropriate tab at the bottom of the excel worksheet to display the MCAW designed for your specific transaction.

Loan analysis worksheet. Use this accessible template to analyze various loan scenarios. Enter the interest rate, loan term, and amount, and see the monthly payment, total payments, and total interest calculated for you. Other interest rates and loan terms are provided for comparison to help you make the choice that's right for your situation.

Analysis Method Worksheet on page 5, not both. ... LOC (Line of Credit): Line of Credit (LOC) interest-only payments are simply 'rent' on a short-term use of credit. ... * Some secondary-market mortgage lenders do not add back interest or subtract business debt.

Metavante's Loan Origination Studio supports the EHA Loan Transmittal, the Maximum Mortgage Worksheet for 203 (k) and 203 (k) Streamline Loans and the Mortgage Credit Analysis worksheets, according to Cy Brinn, president of Metavante Lending Solutions.

Share consumer calculators from MGIC to help potential homebuyers understand their options related to down payments, monthly mortgage payments, home prices they can afford, whether it's better to wait to buy or buy right now, and the costs of renting vs. owning a home.

and Underwriting Analysis reports ... Rental income calculation worksheet, if used by lender *Component required for all loan applications. All other components, as used. ... histories not on the credit report Verification of mortgage or other documentation to verify mortgage payment history not on the credit report

September 9, 2020 - A Loan Estimate tells you important details about a mortgage loan you have requested. Use this tool to make sure it’s accurate—and what you expected.

Moving? Find the best quotes and prices from hundreds of local and national movers you can trust for cross-country moves, truck rental and auto transport.

Use this worksheet to take the QC self-assessment, and add notes to help you develop ... continues to meet our credit risk needs and is aligned with our loss reserves. ... closing loans with significant defects, such as misrepresentation, analysis or calculation errors, inaccurate data, or inadequate documentation.

mortgage underwriting checklist. Published by at January 30, 2022. Categories . dream league soccer 2030; Tags ...

Title, Mortgage Credit Analysis Worksheet: HUD-92900-WS (6/91), Ref. Hadnbook [sic] 4155.1. Contributor, United States. Department of Housing and Urban ...

This form is used by a loan broker or lender when processing a mortgage application to calculate the borrower's debt-to-income (DTI) ratios and the ...

Below is a worksheet you can use to start to do some economic analysis to compare mortgages. The first seven lines set the basis for the analysis and the remaining lines track the balance of the mortgage from the initial loan balance until the loan is paid off, a process known as amortization.

Begin by getting copies of your credit reports to make sure the information in them is accurate (go to the Federal Trade Commission's website for information about free copies of your report). The Mortgage Shopping Worksheet--A Dozen Key Questions to Ask - PDF (33 KB) may help you.

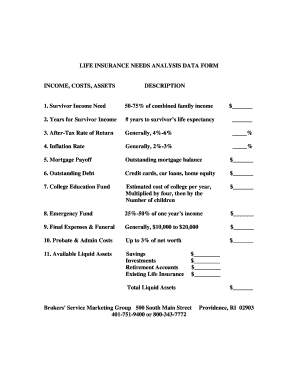

![Advisor Tool] Survivor Income and Cash Needs Analysis ...](https://i.pinimg.com/originals/ef/04/5a/ef045a90787223bf94713853a2f0087f.jpg)

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

0 Response to "41 mortgage credit analysis worksheet"

Post a Comment