42 funding 401ks and roth iras worksheet

Roth IRAs and 401(k)s: Answers to Readers' Questions ... These accounts include the Roth variety of individual retirement account and also the Roth type of company-sponsored 401(k) savings plan. ... Contributing to an after-tax account in a 401(k) plan is one way to build a source of retirement income with little tax impact when needed. Many 401(k) plan participants are surprised to learn that their plans might allow them to personally make after-tax contributions to their 401(k) plans in addition to making pre-tax salary deferrals and, potentially, designated Roth contributions.

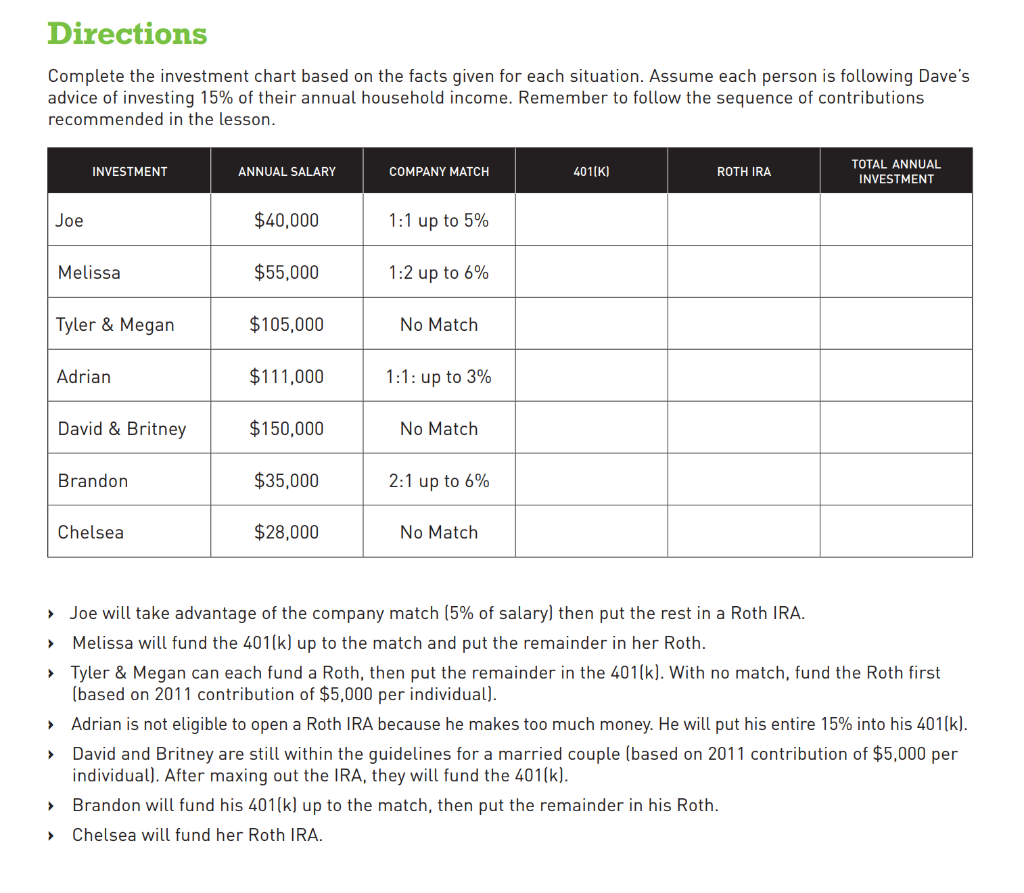

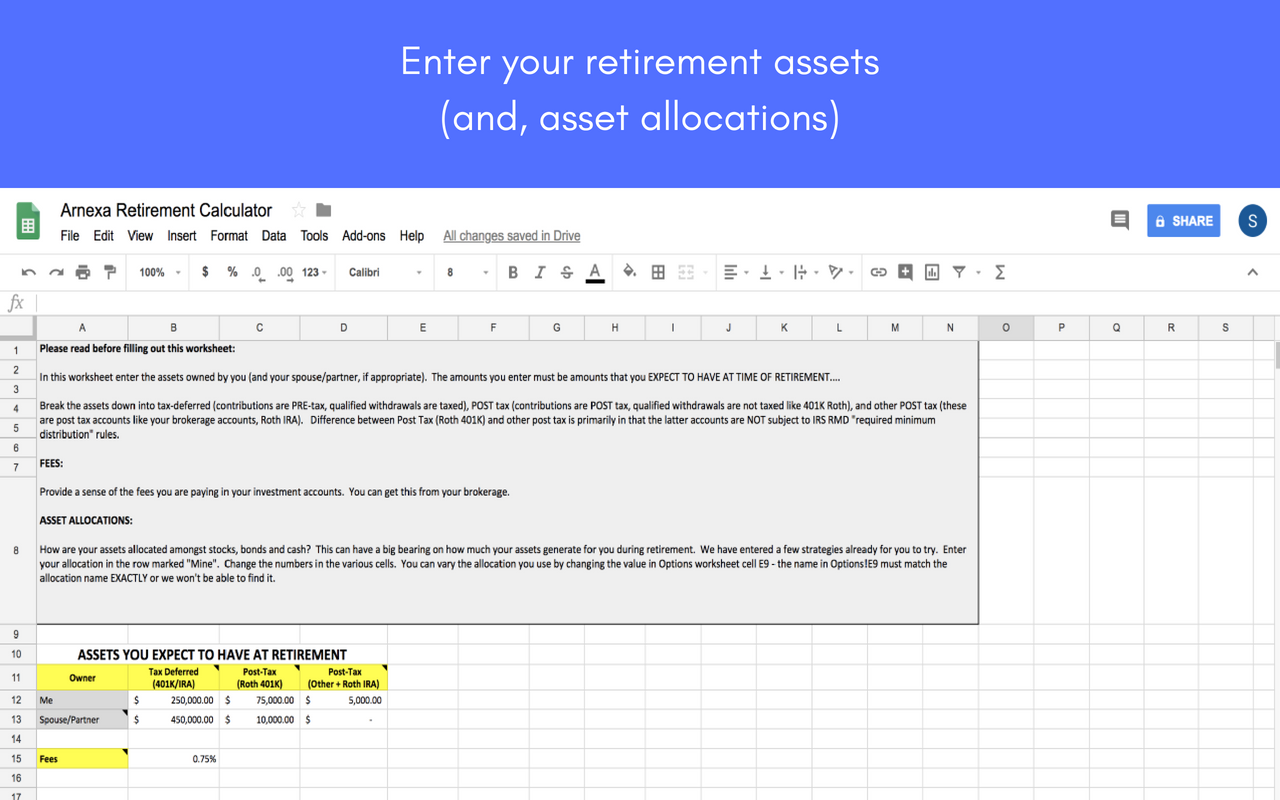

Activity: Funding 401 (k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of ...

Funding 401ks and roth iras worksheet

Chapter 19 Food Safety And Storage Worksheet Answer Key - There are numerous methods to teach your preschooler regarding numbers. You can make use of rainbow-themed worksheets or free ocean-themed worksheets to instruct the alphabet along with numbers. Free ocean-themed tasks include manual dexterity, counting, as well as number recognition. The phase-out range for a married individual filing a separate return who makes contributions to a Roth IRA is not subject to an annual cost-of-living adjustment and remains (as in 2020) $0 to ... The RMD rules do not apply to Roth IRA owners while they are alive. The money you place into a Roth IRA is already taxed. Since the money you take out is tax-free at that point, the IRS doesn't require an RMD on Roth IRAs. Any money you take out of your Roth IRA is tax-free, including money from an annuity inside your Roth IRA.

Funding 401ks and roth iras worksheet. 401 (k) Plans. A 401 (k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee's taxable income (except for designated Roth deferrals). Employers can contribute to employees' accounts. Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Funding 401 K S and Roth Iras Worksheet Answers Beverly Bryant Mar 06, 2021 0 Comments A Funding 401 K Sage IRA Worksheet answers some common questions of IRA conversions and IRA custodians. The worksheet answers the following questions: "What is a Conversion?" Funding 401ks and roth iras worksheet. It was from reliable on line source and. Truly we have been remarked that funding 401 k s and roth iras worksheet answers is being just about the most popular issue on the subject of document sample right now. Funding 401ks and roth iras worksheet answers chapter 8 is free hd wallpaper.

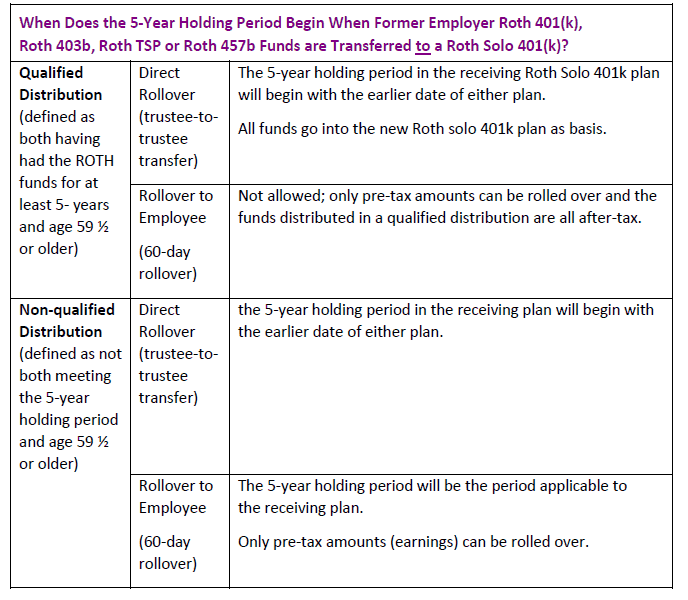

Funding 401ks and iras worksheet and best 25 retirement savings amp. We think it bring interesting things for funding 401 k s and roth iras worksheet answers along with assignment create a roth ira assignment create a. Excel 2007 along with the newest 2010 improve break the previous hurdles about the range of columns and rows available. Nov 18, 2021 ... Roth 401(k), Roth IRA, and Pre-tax 401(k) Retirement Accounts · 2022 – modified AGI married $214,000/single $144,000 · 2021 - modified AGI married ... Funding 401ks and Roth Iras Worksheet with Preschool Printable Worksheets Free Super Teacher Workshee Download by size: Handphone Tablet Desktop (Original Size) Your 401k is all about saving money. It provides a good amount of income, if you were to hold onto it until retirement. Nov 8, 2021 ... When you roll over a distribution from a designated Roth account to a Roth IRA, the period that the rolled-over funds were in the designated ...

Free Printables Worksheet Funding 401 K S And Roth Iras Worksheet Answers We found some Images about Funding 401 K S And Roth Iras Worksheet Answers: Roth vs. Traditional 401 (k) Worksheet. Membership Home Portfolio Stocks Bonds Funds ETFs CEFs Markets Tools Real Life Finance Discuss. Articles & Analyst Reports. All Fund Analyst Reports. Target ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually.

Jan 03, 2022 · Funding 401 K S and Roth IRAs Worksheet Answers There are lots of worksheets on the internet to aid individuals to comply with the treatments for an identity theft instance. Funding 401ks and roth iras worksheet work extremely well from a teachertutorparent to enrich the content an understanding of their studentchild.

View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual

Funding 401 K S and Roth IRAs Worksheet Answers - There are lots of worksheets on the internet to aid individuals to comply with the treatments for an identity theft instance. A worksheet, Get Sheet Name A workbook includes a selection of worksheets. It will be pictorial. The estimating worksheet was made to direct you.

Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Funding 401(k)s & Roth IRAs Directions: Complete the investment chart based on the facts given for ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Dec 29, 2021 ... You can contribute to an IRA even if you also are contributing to a ... Wooden blocks stacked on coins with text ″IRA″ ″ROTH″ and ″401K.

401 (K) defined contribution plan offered by a corporation to its employees, which allows employees to set aside tax-deferred income for retirement purposes; in some cases, employers will match their contributions. 403b. same as 401k but is used for nonprofit organizations such as schools, hospitals, and churches.

The Roth Solo 401k is the best retirement plan for self-employed and small business owners. With the potential increase of federal and state income tax rates, the ability to generate tax-free returns from your IRA investments is the last surviving legal tax shelter. With this plan, you can make almost any type of investment tax-free.

1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k)

p Roth 401(k): Multiply the maximum allowable amount by 1 plus your tax rate (for example, 1.24 if you're in the 24% tax bracket). Then divide that amount by your total salary to arrive at your ...

Direct And Inverse Variation Worksheet With Answers, ... Funding 401 K S And Roth Iras Worksheet Answers, Scale Drawings Worksheet 7th Grade, Significant Figures Worksheet Answers Chemistry ...

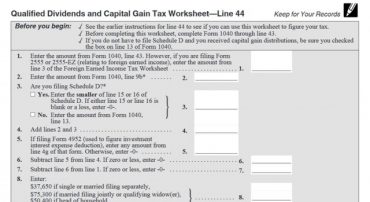

If you took a Roth IRA distribution (other than an amount rolled over or recharacterized or a returned contribution) before 2020 in excess of your basis in regular Roth IRA contributions, see the Basis in Roth IRA Conversions and Rollovers From Qualified Retirement Plans to Roth IRAs chart to figure the amount to enter on line 24.

401(k), 403(b), 457 When it comes to IRAs, everyone with an income is eligible The maximum annual contribution for income earners is as of 2008. Remember: IRA is not a type of It is the tax treatment on virtually any type at a bank. of investment. The Roth IRA is an The Roth IRA has more -tax IRA that grows tax Higher at retirement.

Bankrate.com provides a FREE 401k or Roth IRA calculator and other 401(k) calculators to help consumers determine the best option for retirement possible.

The new Roth 401(k) feature in your plan allows you to invest after-tax dollars (allowing them to grow on a tax- deferred basis) and take qualifying distributions tax-free. The following questions and answers will help you decide if Roth 401(k) contributions are right for you.

Use these free retirement calculators to determine how much to save for retirement, project savings, income, 401K, Roth IRA, and more.

Here's how to compare 401(k)s, different IRAs, and retirement plans for the ... If employer offers traditional and Roth 401(k)s, participants can fund both ...

The Funding 401ks and Roth IIRAs Worksheet is a very useful tool for employees. It is essential for anyone who wants to invest in their IRAs. By creating a plan, you can maximize your savings and minimize taxes. So, use it wisely. It's also an excellent source of information for those who want to save for retirement.

Employees can make pre-tax or Roth (after-tax) contributions. ... Participants can choose from more than 100 Vanguard mutual funds, including many from our ...

The RMD rules do not apply to Roth IRA owners while they are alive. The money you place into a Roth IRA is already taxed. Since the money you take out is tax-free at that point, the IRS doesn't require an RMD on Roth IRAs. Any money you take out of your Roth IRA is tax-free, including money from an annuity inside your Roth IRA.

The phase-out range for a married individual filing a separate return who makes contributions to a Roth IRA is not subject to an annual cost-of-living adjustment and remains (as in 2020) $0 to ...

Chapter 19 Food Safety And Storage Worksheet Answer Key - There are numerous methods to teach your preschooler regarding numbers. You can make use of rainbow-themed worksheets or free ocean-themed worksheets to instruct the alphabet along with numbers. Free ocean-themed tasks include manual dexterity, counting, as well as number recognition.

0 Response to "42 funding 401ks and roth iras worksheet"

Post a Comment