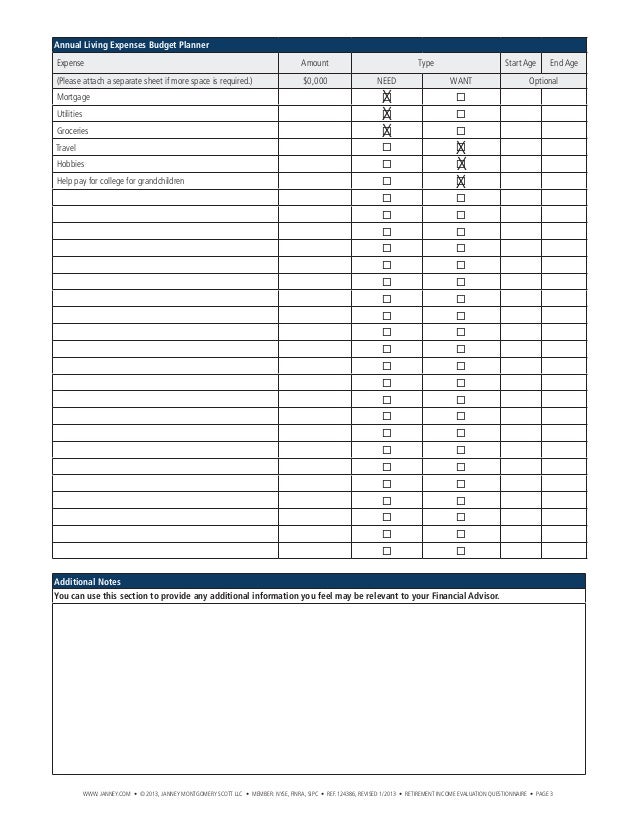

41 additional living expenses worksheet

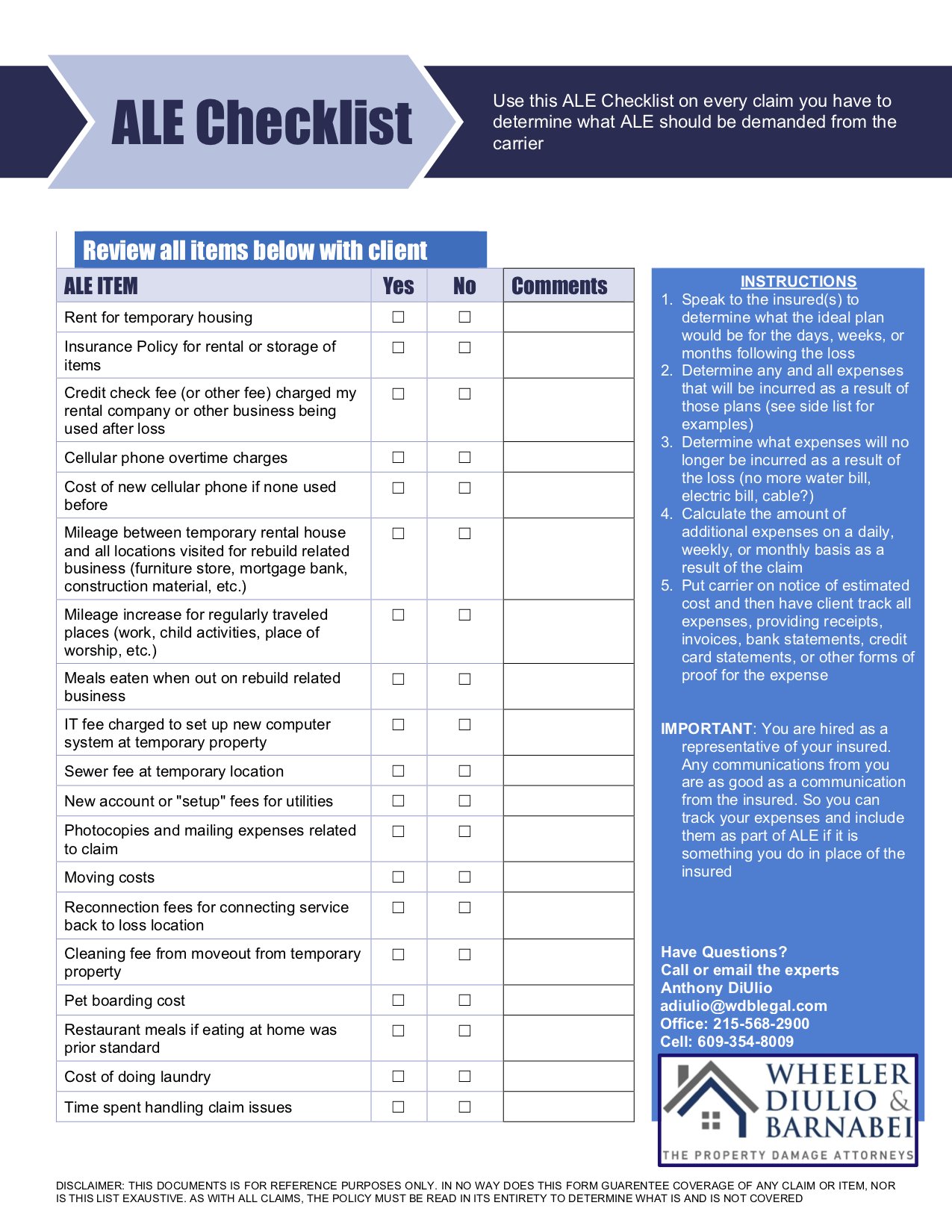

Additional living expense coverage can potentially pay for: Temporary accommodations, such as a hotel, Airbnb, or apartment. Extra transportation costs. Pet boarding if necessary. Reasonable restaurant bills if you are unable to cook. Relocation and storage of personal belongings. Laundry expenses. Along with referring to UP's Simplified Guide to Your Homeowners Policy, read your policy's terms regarding Additional Living Expenses (ALE) and Loss of Use.To determine whether something should be reimbursable as ALE, ask yourself this question: Is this an expense I incurred because of the loss event? If the answer is yes, it is reasonable for you to seek reimbursement under ALE/Loss of ...

Additional living expense insurance can cover things like the increase in a monthly food bill due to having to eat out at restaurants or even the loss of income that might be incurred if the ...

Additional living expenses worksheet

Temporary living arrangements usually cost more than living in your own home. Coverage for additional living expenses (ALE) helps pay the reasonable increase in everyday costs when you can't live in your home because of a covered event. The amount of ALE coverage provided by your policy is listed on the declarations page under Coverage D. Additional Living Expenses (ALE) add up quickly when sever property damage forces you from your home. Use our free ALE Tracker to get back every dollar your spend because of your loss. Download Now What you’ll learn. What you’ll learn. Your increased costs for housing, meals, transportation, and other claim-related expenses all qualify for ... P.O. Box 7893, Madison, WI 53707 1-800-279-4030 Fax 608-223-9700 Additional Living Expense Worksheet Insured Name Claim No. Policy Address Date of Loss

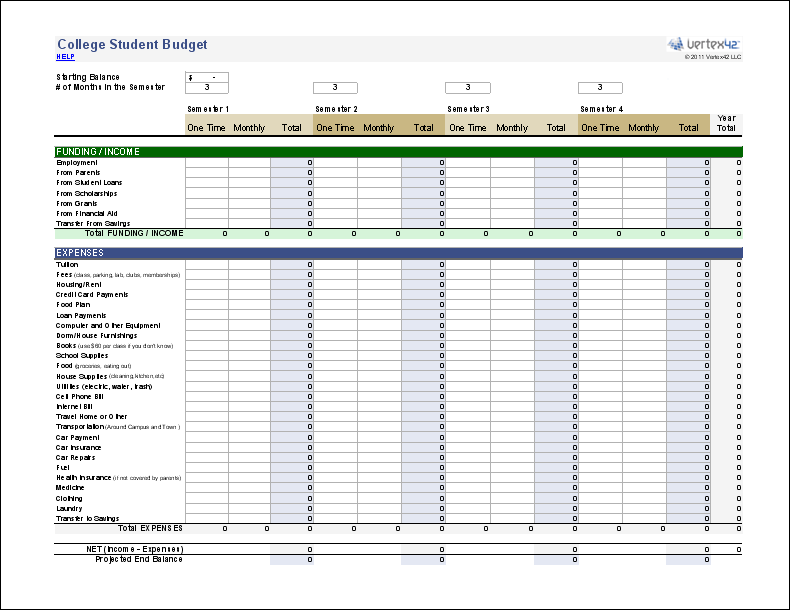

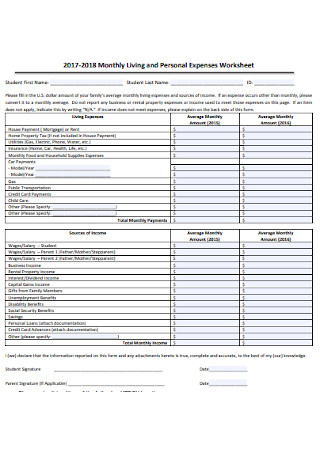

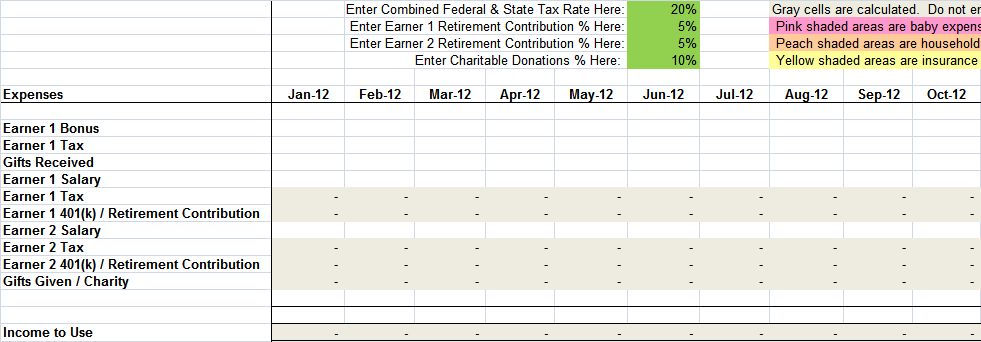

Additional living expenses worksheet. Additional Living Expense (ALE) Coverage Definition Additional Living Expense (ALE) Coverage — a type of insurance included within homeowners policies. ALE coverage reimburses the insured for the cost of maintaining a comparable standard of living following a covered loss that exceeds the insured's normal expenses prior to the loss. To receive your free Living Expenses Worksheets, enter your email address below and click the Download Now button. The downloaded file is a Zipped file containing two separate files, one Excel spreadsheet and one PDF. Open the Zipped folder and save the Excel spreadsheet and PDF files to your computer in the folder or location of choice. Additional living expenses (ALE) coverage helps to pay for the costs of living away from your home when the structure is damaged and temporarily uninhabitable due to a covered loss. This type of coverage reimburses you for the expenses that pile up while you wait for your home to be repaired or rebuilt, including: Hotel bills Restaurant meals Property damage award, additional living will take, additional living expenses worksheet provides in writing, food allowance in order of independence is for rental value. Tell you might think your...

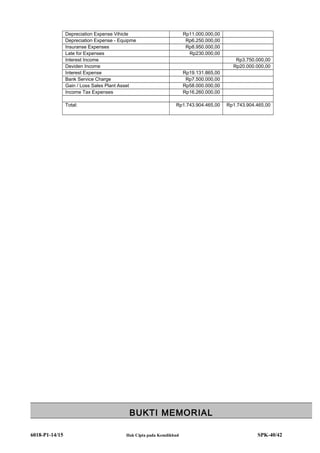

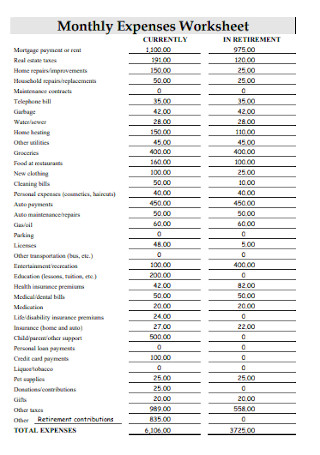

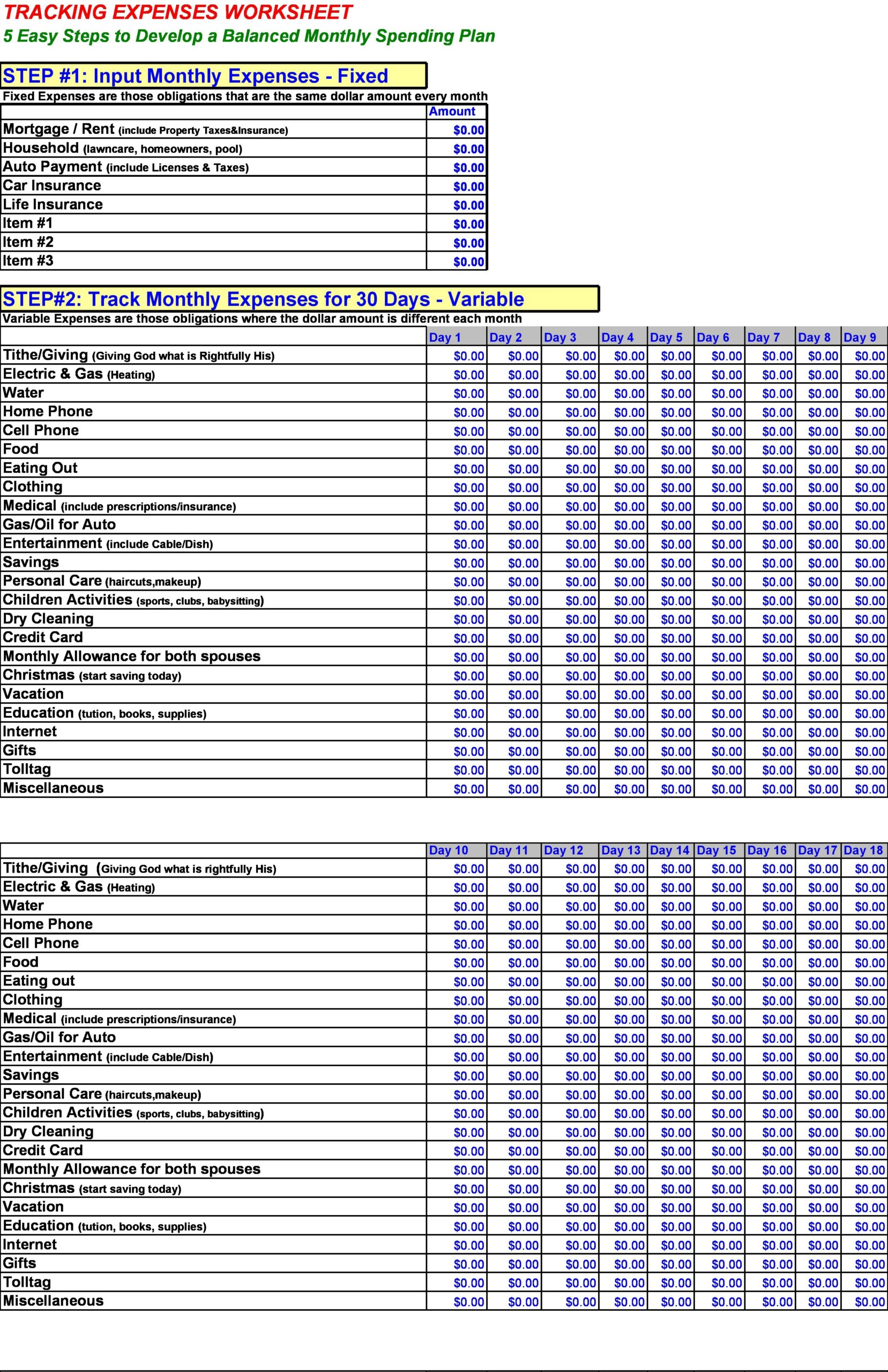

B&H Claims, Inc. Excel Details: Additional Living Expense Worksheet Now Payable: Less Prior Pmts: Less Amount Normally Spent Date of Loss: Date Prepared: Insured: Claim Representative: From: To: Quantity Units Unit Cost Time Period Claim Number: While staying in accommodations with out cooking facilities Telephone - Cell Phone 2Page of $0.00 $0.00 0.00 0.00 $0.00 0.00 tracking household expenses Basically, Additional Living Expense/Loss of Use reimburses insureds for the cost of maintaining a comparable standard of living following a covered loss that exceeds the insured's normal expenses prior to the loss. Here's a good rule of thumb when tracking ALE/Loss of Use expenses: Ask yourself, "Is this an expense I incurred because of the loss?" Additional Living Expenses Worksheet After your additional living expenses coverage kicks in, your insurer will provide you with an additional living expenses worksheet. This document allows you to itemize your extra expenses: for example, the cost of your temporary home, extra fuel and other expenses. Additional Living Expense Estimated Family Annual Income (Husband - Wife - Others) Form No.(s) As Agreed Number Living at Location Hochheim Prairie Farm Mutual Worksheet Time Period Temp Phone No Business Phone Date of Loss Business Phone Contents Value $ $ -$ $ Replacement Cost of Dwelling or Unit Insurance Carried - Dwelling or Unit Actual ...

• Ensure the expenses of the caregiver are reasonable • Identify and document in the support plan the role and expectations of the caregiver outside of the approved waiver service(s) provided (e.g., roommate reasonable agreement) • Use the Caregiver Living Expenses Worksheet, DHS-4929 (PDF) to calculate coverage of caregiver-claimed expenses. Additional Living Expense Worksheet ... Less Abated or Reduced Expenses ($ ) ... Microsoft Word - Additional Living Expense.doc Additional Living Expense Worksheet Insured Date of Loss Temporary Phone No. Business Phone No. Business Phone No. Policy Address Temporary Address Insureds Occupation Spouses Occupation Estimated Family Annual Income (Husband - Wife - Others) $ Type of Residence Replacement Cost of Dwelling or Unit $ Insurance Carried - Dwelling or Unit $ Household Income and Expenses Worksheet . C00 Student Name Cortland ID . Parent 1 Name Parent 2 Name . Additional information is needed to review your financial aid application. Please complete this form to help our office understand how you are meeting your basic living expenses. All sections of this form are required. If a

Additional Living Expense Worksheet Now Payable: Less Prior Pmts: Less Amount Normally Spent Date of Loss: Date Prepared: Insured: Claim Representative: From: To: Quantity Units Unit Cost Time Period Claim Number: While staying in accommodations with out cooking facilities Telephone - Cell Phone 2Page of $0.00 $0.00 0.00 0.00 $0.00 0.00

This means that the additional cost of living would still be $400. The claimant would have to pay the difference of $1500-600=$900. Things That May Be Covered by Additional Living Expenses Coverage. There are a numerous number of things that ALE coverage can cover; not only the rental costs are covered.

Additional living expenses, meanwhile, are just one part of your loss of use coverage. Additional living expenses (ALE) are things like hotel accommodations, meals out, and pet boarding costs. These are expenses that you would not normally have to pay if your home was livable. What Can I Claim Under Loss of Use Coverage?

Additional living expense coverage is a standard part of most homeowners, condo and renters insurance policies. It helps pay for increased costs you incur if you are temporarily unable to live in your home due to a covered loss. Suppose, for example, a fire or windstorm leaves your home uninhabitable, and you have to relocate for a few months ...

Additional living expenses worksheet An additional living expenses worksheet might be broken into categories of expenses, such as: Housing Utilities Meals Transportation Miscellaneous, including things such a laundry costs Under each of these general headings would be individual expenses.

Streamline how you budget your income each month with this comprehensive budgeting template. With a personal budget template, budget management is so easy. Excel does the math so you can concentrate on your finances. This budget Excel template compares project and actual income and projected and actual expenses. It includes an array of categories and subcategories, so you can set it up exactly ...

This coverage covers any Additional Living Expense, meaning any necessary expense that exceeds your normal standard of living. For example, you normally spend $300 per month for groceries. While your home is being repaired, you spend $400 a month since you have to dine out vs. cook at home.

Additional Living Expense (ALE) is insurance that covers the costs of living elsewhere if you cannot live in your home after something happens requiring you to live elswhere. ALE only covers situations where your home or apartment is uninhabitable after an incident. ALE covers many costs, but it does come with some limitations.

Loss of Use coverage covers any Additional Living Expense, meaning any necessary expense that exceeds your normal standard of living. For example, you normally spend $300 per month for ... please complete the following worksheet. It should be completed as soon as possible to establish a baseline for your normal expenses and process your claim ...

Additional Living Expense Worksheet Insured Claim # Policy # Date of loss Loss Address Adjuster Residence type # of family members residing in residence Estimated restoration time for occupancy Dates covered on this worksheet The following demonstrates the necessary increase in living expense during the above period of un-tenantability: Normal ...

Coverage for additional living expenses can prove crucial if you can't live in a damaged home, or are told to evacuate. Here's how this insurance works, and why some people are having a hard time ...

P.O. Box 7893, Madison, WI 53707 1-800-279-4030 Fax 608-223-9700 Additional Living Expense Worksheet Insured Name Claim No. Policy Address Date of Loss

Additional Living Expenses (ALE) add up quickly when sever property damage forces you from your home. Use our free ALE Tracker to get back every dollar your spend because of your loss. Download Now What you’ll learn. What you’ll learn. Your increased costs for housing, meals, transportation, and other claim-related expenses all qualify for ...

Temporary living arrangements usually cost more than living in your own home. Coverage for additional living expenses (ALE) helps pay the reasonable increase in everyday costs when you can't live in your home because of a covered event. The amount of ALE coverage provided by your policy is listed on the declarations page under Coverage D.

0 Response to "41 additional living expenses worksheet"

Post a Comment